Engineering Strategy Guide - The game you play

Tech strategy guide for tech leaders. Understand the business

Table of contents

1. Understand the business model

1.1 Canvas, Excels, PowerPoints, or the CEO’s head

1.2 The game you are playing

1.3 Bootstrapped or Venture Capital

1.4 Follow the money

1.5 Consumers, Enterprise, or all in between?

1.6 The user needs, why do they buy you?

1.7 Flow of change

1.8 Business model types and margins

1.9 Relevant metrics

1.10 Funnels and loops

2. Connecting the business knowledge with the engineering strategy

2.1 Before starting understading the business

2.2 During understanding the business

2.3 After understanding the business

Can you design a good engineering strategy without understanding the business? No.

In the first designing an engineering strategy post series, I remark that:

An engineering strategy addresses a high stake business challenge from an engineering perspective.

You can check the full post here 👇

Does it mean that you need to become a business expert to design a good engineering strategy? Not at all.

Instead, what I do is partner with the business people.

I ask them a lot of questions:

Why the business runs this way?

Which is the business model?

Which is the money flow?

In which game are we playing and why this bets over that ones?

The business people aren’t necessary sales, they are domain experts (using the DDD vocabulary) or subject-mater experts (SME), from whom we can learn a lot.

A good engineering strategy feels like the business strategy

from an engineering point of view.

When you explain them, they feel like one and coherent with each other.

In this post, I want to provide you some guideline on how to understand your business better by knowing what to ask the domain experts to gain meaningful insights that will help you:

Design good engineering strategies that address the high-stake business challenge.

Communicate better how this strategy is aligned with the business using a shared vocabulary.

Create stronger relationship with other people within your organization

Empathize why the business does what it does, and how you can contribute.

The key aspect during researching to understand the business is to keep an open-mind and be understandable that no one can have the best and perfect answers.

If you find yourself with not enough responses, partner with the person to improve that area for a better future.

Working together on this is super beneficial for the whole organization. Just remember to do it with small steps, rather than stopping everything to have a response that suits your needs. Embrace uncertainty.

1. Understand the business model

1.1 Canvas, Excels, PowerPoints or the CEO’s head

If you are in a startup, the founders probably did a business model canvas, a lean model canvas, or something that will be outdated, but the important aspect is the expectations and implicit reasoning behind it.

In case you don’t have a canvas to kick off the conversation, you can have the same result with some Excels, or PowerPoint that have been used to communicate in some leadership meetings, or during the onboarding.

In case you don’t have anything of that to kick off, then you will need to do a coffee with the CEO for example, and start creating those materials yourself for future need.

Questions to ask

Which is the core value proposition?

How do we distribute our products?

Why those channels over others?

Which are our clients/users?

Which is our main cost?

Which is our main revenue stream?

1.2 The game you are playing

I love the North Star Framework because it helps you understand a lot of the business.

Even though the most famous aspect is the North Star Metric, I consider that how they explain how you have to understand the game you play to be relevant for the engineering strategy.

They describe that any business can be categorized into the next three games:

• The Attention Game

How much time are your customers willing to spend in your product?

• The Transaction Game

How many transactions does your customers make in your product?

• The Productivity Game

How efficiently and effectively can someone get their work done?

Questions to ask

Which is our game?

Which is our north star metric?

How does that affect how to create value and capture it?

How the current initiatives contribute to the goal?

1.3 Bootstrapped or Venture Capital

A bootstrapped business is self-founded, while a VC business requires external founding. Each have different benefits and drawbacks, and they will influence which decisions you can make.

1.4 Follow the money

How money is invested will determine a lot the engineering strategy. Are the teams founded by VC money? Are they sustained by the revenue generated by clients?

Questions to ask

When a customer pays €1, what happens to it?

How does it get invested?

Which are the expectations of that investment?

Where are you more willing to invest, and where are you more cautious?

How much goes to marketing? To people? To tech?

If we are not profitable, how do we cover the structural costs?

1.5 Consumers, Enterprise, or all in between?

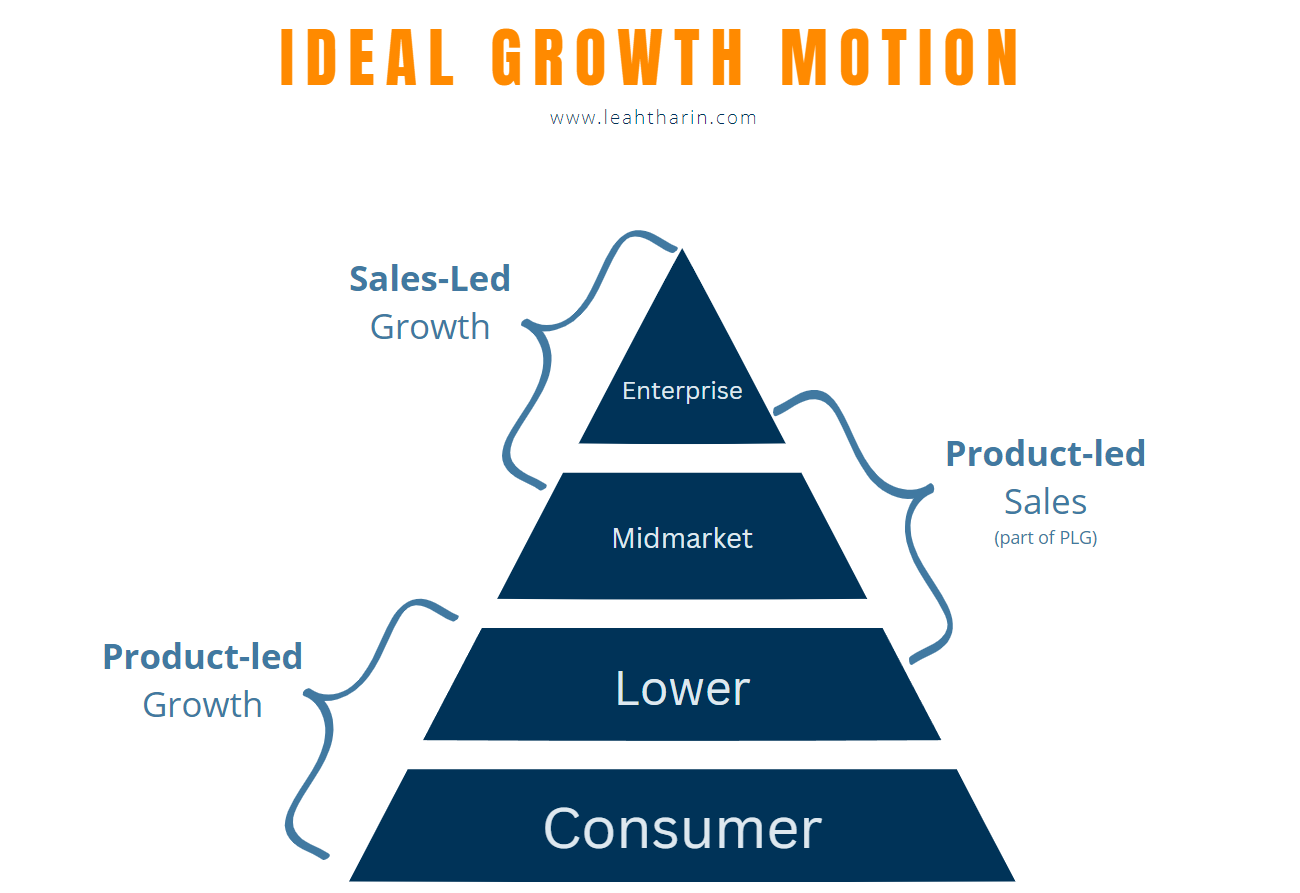

Product-led Growth

The most cost-efficient distribution model in B2C and lower B2B markets.Product-led Sales

It leverages customer signals and data to enrich deal qualification to identify long-term revenue before the customer even pays. This drives down our CAC, Cost to Serve, deal cycle times, and most importantly payback period.Sales-led Growth

Great for products that cannot be self-served due to their complexity. Better used for up-market like enterprise.

You can learn more here 👇

Questions to ask

Are we or do we plan to move up-market or downmarket? Why?

If we are PLG (or another), how does that affect our structure and expectations?

Why are we targeting lower market instead of enterprise?

If we had to target the enterprise, how the organization will be affected? Why not doing that?

1.6 The user needs. Why do they buy you?

You cannot create a good engineering strategy if you may understand the business but not the user needs. You need to understand both to fulfill their needs on the long term.

Questions to ask

Which are our users/clients?

Why they and not others?

Which are their needs?

Are we providing a solution for those needs?

Is that solution fulfilled by the product, or is it human based?

Is it our core value proposition? Is it a bet? Or is it the cost of doing business?

1.7 Flow of change

An initiative doesn’t appear from the vacuum. Someone started it. You need to understand how those initiatives happen in the first place and how it affects the flow of change on the long term.

This includes:

Idea to founded initiative.

Prototyping, creating the product, distributing, capturing value, legal, …

How the work is distributed.

If new teams are needed, how they are created, by whom, which hiring process.

Questions to ask

When an idea happens, how does it reach production?

Who decides which ideas become initiatives and get funded?

When an initiative starts, how all the departments contribute to the initiative?

Which are the needs of each department to make an initiative happen?

Where do you find the most friction to make it happen?

What would you make different next time?

If an initiative requires more people, how a new team is created?

1.8 Business model types and margins

Type of business:

Model A. The value and the cost scale linearly together.

Model B. The value and the cost don’t scale together.

An example of model A can be a marketplace, serving more customers requires a higher cost. The margins are lower.

On the other hand, a model B can be a SaaS in which the cost of building it keeps “enough static” but the value scales a lot. The margins are huge.

While a Model A doesn’t require a huge upfront investment, the Model B requires it. That’s why business on Model B are always talking about reaching the Break-even.

Questions to ask

Are we more like model A or B?

For model A:

Which is our margin?

Where they come from?

When do we lose our margin?

For model B:

Which is the estimate time to reach break-even?

Which is the current cost? Is it the labor? Is it the platform?

How do we sustain the current structure?

What do we need to reach break-even?

1.9 Relevant metrics

Become familiar with common metrics that usually apply to all businesses.

CLTV - Customer Lifetime Value

Total value generated by the client during the whole live as a client.ARPU - Average Revenue per User (per month or per year).

CAC - Customer Acquisition Cost

Mean cost of acquiring a customer.CAC payback

The time it takes you to recover the investment to acquire a customer.Churn rate

Percentage of clients that they cancel during a period of time.CLTV / CAC ratio

Sales efficiency.

COGS - Cost of Goods Sold

The direct costs of producing the goods sold by a company. This amount includes the cost of the materials and labor directly used to create the good. It excludes indirect expenses, such as distribution costs and sales force costs. This is sometimes adapted for some business models like SaaS. I found companies excluding the labor cost as it keeps quite static as you can see in the previous figure model B.

Questions to ask

Which are the relevant metrics for the business?

How do they relate to our business goals?

Which initiatives are we doing to influence them?

Any expectations on how they should look like in the mid-long term?

Do we know the value of this metrics (the previous ones I listed)?

1.10 Funnels and loops

Several organizations use some kind of funnels or loop frameworks to measure and impact from how they acquire a customer and how that converts into revenue.

The most common one I found is the AARRR Pirate Metrics, but I have seen an adopting of growth loops frameworks.

Questions to ask:

Which is the current ratio?

Is it OK for now, or are we actively working to improve some area? Why?

Which teams/departments are involved in each step of the funnel?

How does an initiative to improve a step of the funnel affects the team’s work?

2. Connecting the business knowledge with the engineering strategy

Understanding the business is a forever job. You cannot stop learning about it. The more you learn, the better the engineering strategy will become.

A great activity you can do to measure how much did you learn is the next. I hope you are able to see that you improved your situational awareness.

2.1 Before starting understading the business

Focus on putting everything you think you know about the business and the engineering strategy.

Save a duplicate of your engineering strategy.

If you don’t have one, create a document with the implicit strategy that you have. Even though it can seem like poor, it is totally worth.

Create a document in which you will try to answer some of the questions by yourself that I listed in this post.

Save that document and not share it yet.

2.2 During understanding the business

Create a new document in which you can share with the domain experts to capture the conversation.

Ask domain experts to link to the relevant information. Better to start asyncronously.

Collect the information and interpreation into this document.

Ask domain experts if your interpretation is correct.

Have a 1h session to go into details and collect those conversations the best you can.

2.3 After understanding the business

Write a new document with a fresh engineering strategy that you consider that addresses the new learnings you had about the business.

Compare before talking to the business and after. Did you learn? 😄

Thank you a lot for reading this post 😄.

I love to read your feedback and opinions to help me improve. You can DM at my LinkedIn or just leave a comment using the following links: